SSM Business Termination

Hassle-free renewal of your business or company registration with professional support.

Consult and find solutions!

Business Information

Description

Terminate SSM in Malaysia: Steps, Procedures, and Importance

As an entrepreneur or business owner in Malaysia, registering with the Companies Commission of Malaysia (SSM) is one of the essential requirements to ensure that your business is legally valid. However, there may be times when you may need to terminate your business’s SSM registration, whether due to the business no longer operating, company closure, or other reasons. This article will discuss in more detail the SSM termination process, the steps to take, and why it is important for your business.

Termination of SSM business can be registered for the following reasons:

Cessation of business

Bankruptcy

Death of owner

Court order

What is Termination @ Terminate SSM?

Termination @ Terminate SSM is the official process to close or stop the registration of a business that has been registered under the Companies Commission of Malaysia (SSM). When a business is no longer active or not operating, termination must be done so that your business records are closed and do not cause any problems in the future, especially related to legal obligations, taxes, and business liabilities.

This SSM termination is important because if your business is not officially terminated, you may be subject to penalties, fines, or face other problems, such as unnecessary tax payments.

Why is SSM Termination Necessary?

There are several reasons why SSM termination is required for a business that is no longer operating. Some of the main reasons include:

A business that is not formally terminated will continue to be considered operating in the eyes of the law. This can leave the business owner responsible for taxes, fines, and other liabilities that arise. Formal termination releases the owner from these responsibilities.

Even if the business is not operating, if the SSM is not terminated, you may still have to pay business taxes or annual fees. Termination will end this obligation.

Termination also helps ensure that your business name is not used by other parties without your permission.

With a valid termination, your business information will not be used by another party in any detrimental transaction.

SSM Termination Steps

To complete your business registration with SSM, there are several steps you need to follow. This process can be done online through our portal. Here are the steps you need to take:

1. Make Sure All Obligations Have Been Completed

Before terminating your SSM registration, make sure that all business obligations have been settled. This includes tax payments, debt settlement, and any pending business agreements. You need to ensure that there are no outstanding debts or other problems related to your business.

2. Log in to our SSM Portal

The termination process is now easier through the online portal. You need to log in to this portal. If you don’t have an account yet, we will help you register an Ezbiz account for future convenience.

3. Select the ‘Termination / Terminate SSM’ option

Once logged in, select the option to terminate the business. Select the type of business you want to terminate, whether it is a sole proprietorship or a partnership.

4. Fill out the Termination Form

Fill out the termination form with the required information. You will need to provide the reason why the business wants to be terminated as well as further details about the status of the business.

5. Upload Supporting Documents

After filling out the form, you will need to upload the required supporting documents. This may include your latest financial statements, a copy of your ID card, and other relevant documents. Make sure you have all the required documents ready to speed up the process.

6. Payment of Termination Fee

The SSM termination process involves certain fees that need to be settled. This payment can be made through various online payment methods such as FPX.

7. Confirmation of Termination

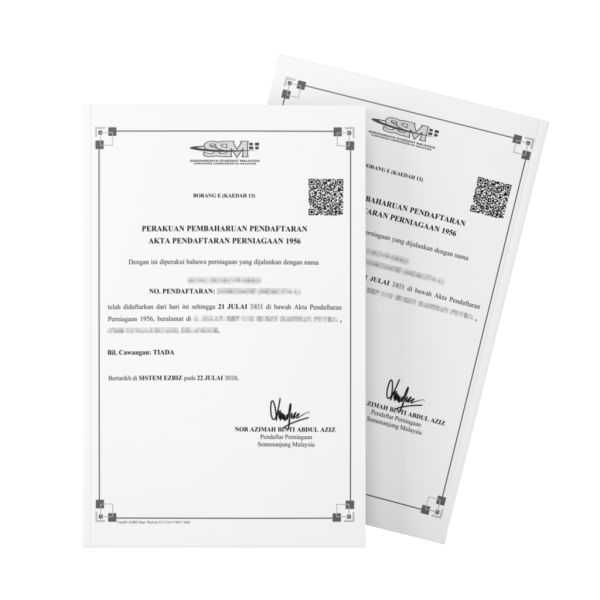

Once the termination process is complete, we will send you a termination confirmation in PDF format to your email and also via WhatsApp. You will receive a termination certificate stating that your business has been officially terminated.

8. Keep a Record of Termination

Make sure you keep a copy of the termination certificate and related documents as proof that your business has been legally terminated.

Advantages of a Valid SSM Termination

- Avoiding Legal Liability A valid SSM termination ensures that you are no longer responsible for any legal liabilities or responsibilities that may arise after the business is terminated.

- Maintaining Business Reputation A business that is not formally terminated can damage the reputation of the business and its owner. A valid termination demonstrates professionalism and the ability to manage the business well.

- A Neat Financial Settlement SSM termination also helps ensure that all financial obligations are settled, including tax and debt payments. This avoids any problems with authorities or financial institutions.

- Avoiding the Risk of Misuse of Business Name If your business is not terminated, others may try to use your business name or registration number without permission.

Factors to Consider Before Terminating SSM

Before deciding to terminate SSM, there are several factors to consider, including:

- Accounting Status : Make sure you update all financial records and business accounts before termination. This will make the closing process easier and avoid any financial problems in the future.

- Tax Obligations : Check if there are any tax arrears that need to be settled before the termination process.

- Bank Account Closure : If the business has a bank account, ensure that the account is closed properly upon termination.

- Employee Payments : If your business has employees, ensure that salaries, benefits, and other compensation payments are made before completing registration.

Conclusion

SSM termination is an important process for business owners who are no longer operating. It helps avoid legal, financial, and other obligations that may arise after the business is closed. By following the right steps and ensuring that all obligations are settled, you can end your business smoothly and without any problems. Don’t let an inactive business negatively impact your future— terminate your SSM registration immediately and manage your business closure wisely.

If you need assistance in the SSM termination process, contact us for quick and easy professional services.

Ready to Register or Apply for a License?

Get in touch with our team today for a professional consultation and tailored solutions.