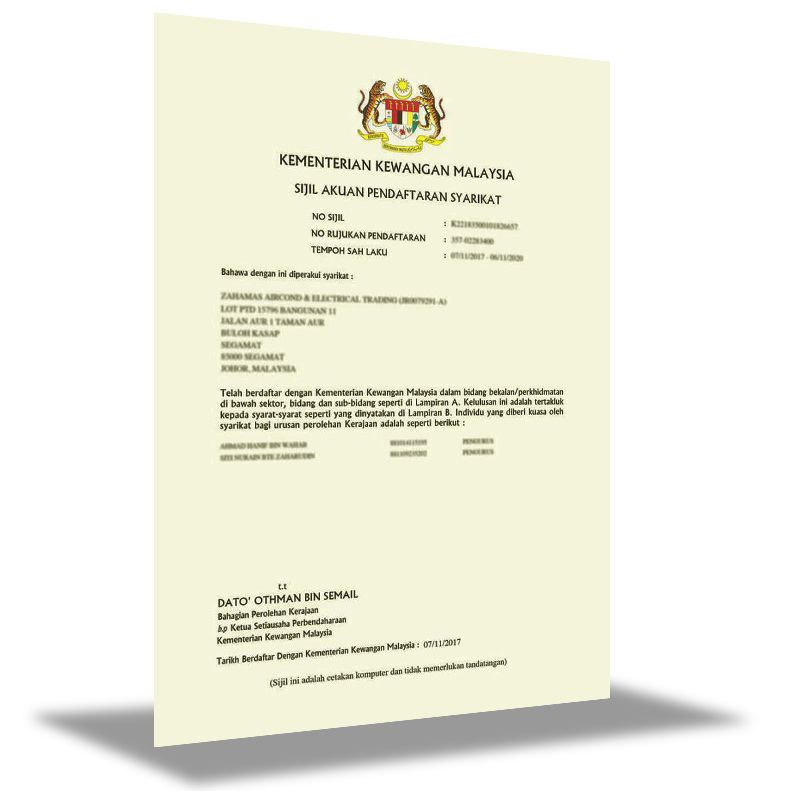

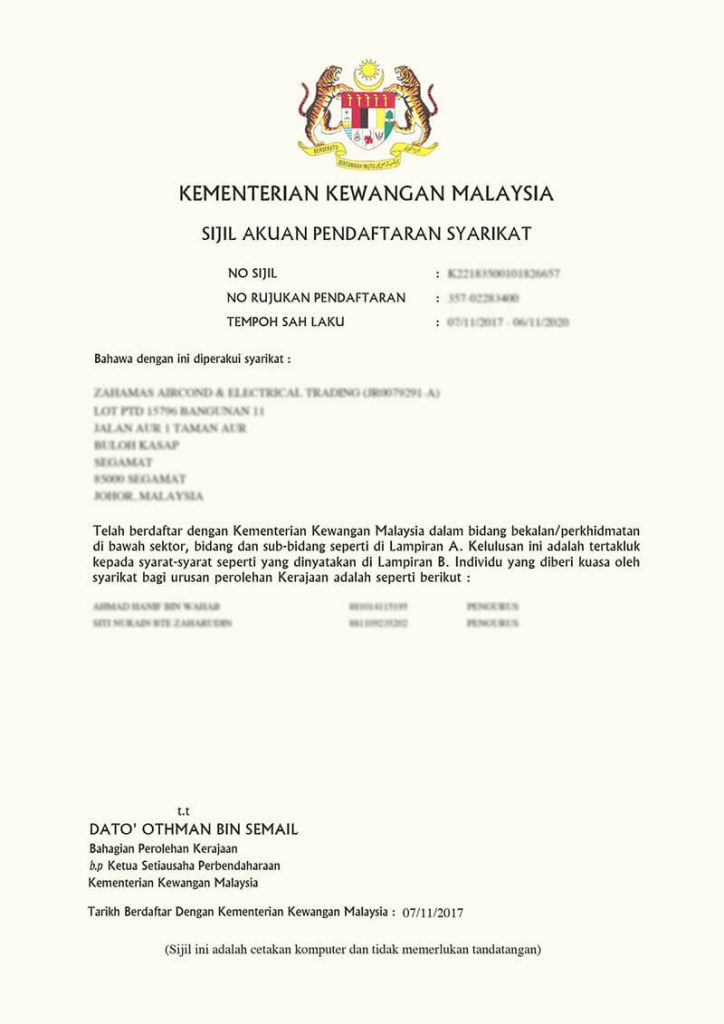

MOF Financial License Registration

Get your financial license approved efficiently with professional guidance and full compliance support.

Consult and find solutions!

Business Information

Description

MOF Financial License Registration: A Complete Guide for Entrepreneurs

Registering for a financial license with the Ministry of Finance Malaysia (MOF) is an important step for any company or individual who wants to operate in the financial sector in Malaysia. With this registration, your business will be legally recognized and can carry out financial activities such as lending, fund management, and other financial services with more confidence. In this article, we will explain the MOF financial license registration process in detail, including the requirements required, the steps to take, and the benefits you will get after registering.

Why is MOF Financial License Registration Important?

MOF financial license registration is not only required to comply with the law, but also provides many benefits to your business. Here are some reasons why this registration is a step that should not be overlooked:

MOF financial license registration ensures that your business operates legally under Malaysian law. Without a valid license, you risk fines or legal action.

Customers are more likely to deal with companies that have valid licenses. This gives customers confidence that your business is professional and trustworthy.

Many business opportunities, including government contracts, require companies to have a valid financial license. With this registration, you can participate in various tenders and projects that can boost your business.

MOF financial license registration helps build a good reputation for your business. Companies with valid licenses are usually seen as more trustworthy and professional in their respective fields.

Requirements for MOF Financial License Registration

Before starting the registration process, it is important to ensure that you meet all the requirements set by the Ministry of Finance. Here are the general requirements that must be met:

- Company Registration : Companies wishing to apply for a financial license must first register with the Companies Commission of Malaysia (SSM).

- Supporting Documents : You need to provide supporting documents such as a copy of the company registration, owner information, and other relevant documents.

- Minimum Capital : There are minimum capital requirements that must be met for certain types of licenses. Make sure you have sufficient capital before applying.

- Applicant Information : Information about the applicant, including background and experience in the financial field, must be provided to help MOF assess your qualifications.

- Establishment of a Board of Directors : Companies applying for a license must have a board of directors with experience in the field of finance or business.

MOF Financial License Registration Process

The MOF financial license registration process can be complicated if you don’t know the steps to take. Here is a step-by-step guide to help you through the process:

1. Document Preparation

The first step in the registration process is to gather all the required documents. These include:

- Copy of company registration from SSM.

- Identification documents of the company owner and director.

- Information about business activities and purpose of application.

- Company financial statements (if any).

2. Fill out the Application Form

Once all documents are prepared, the next step is to fill out the application form provided by the Ministry of Finance. Make sure all information is filled in accurately and completely to avoid any delays in the registration process.

3. Submit Application

Once the application form is completed and supporting documents are attached, submit your application to the Ministry of Finance. You can submit it by post or online through the official MOF portal.

4. Payment of Registration Fee

After submitting your application, you will need to pay the prescribed registration fee. Make sure you keep proof of payment for reference.

5. Review Process by MOF

MOF will review your application and will contact you if any information is incomplete or requires further clarification. This process usually takes a few weeks.

6. License Acceptance

If your application is approved, you will receive your MOF financial license via email or post. Make sure you keep a copy of this license in a safe and easily accessible place.

Mistakes to Avoid

During the registration process, there are several mistakes that can cause your application to be rejected. Here are some common mistakes to avoid:

- Incomplete Information : Make sure all information provided is complete and accurate. Any errors or missing information may result in your application being rejected.

- Documents Not Accepted : Ensure that all required supporting documents are included. Incomplete or invalid documents may affect your application.

- Late Payment : Make sure you pay the registration fee on time. Late payment may result in your application not being processed.

- Failure to Comply with Eligibility Requirements : Ensure that you meet all eligibility requirements set by the Ministry of Finance. Failure to comply with these requirements may result in your application being rejected.

Benefits of Having a MOF Financial License

After obtaining a MOF financial license, your business will enjoy various benefits, including:

- Ability to Provide Financial Services : With this license, you can offer a variety of financial services such as personal loans, business financing, and financial management services.

- Access to a Wider Range of Customers : Customers are more likely to use services from companies that have a valid financial license. This can help increase your company’s customer base and revenue.

- Competitive Advantage : In a competitive market, having a valid license gives you an advantage over unregistered competitors.

- Opportunities to Grow : With an MOF financial license, you can grow your business more easily and participate in government tenders and large projects.

Conclusion

Registering for a MOF financial license is an important step for any entrepreneur who wants to operate in the financial sector in Malaysia. The process may seem complicated, but with the right information and the right steps, you can ensure that your registration goes smoothly.

Don’t wait any longer! If you are planning to run a business in the financial sector, start gathering documents and register for a MOF financial license today. With a valid license, you will open the door to various business opportunities that can help you achieve greater success.

For more information on MOF financial license registration and for assistance in the registration process, please do not hesitate to contact us . We are ready to assist you in every step of your journey towards business success.

Ready to Register or Apply for a License?

Get in touch with our team today for a professional consultation and tailored solutions.